SUMMARY:

The results will prove surprising to some, to be expected by others, but, overall, fail to represent a singular path forward for the industry. The mixed messages resulting from the survey represent both promise and challenges that lie ahead for industry reformers and managers. Survey results reflect the country’s divided political reality as well as the natural biases and ideological persuasion of respondents.

What seems certain is the industry will continue to feel its way, step-by-step, toward reform. How to achieve greater access to healthcare while, at once, improving affordability remains Job #1 for the industry and government alike.

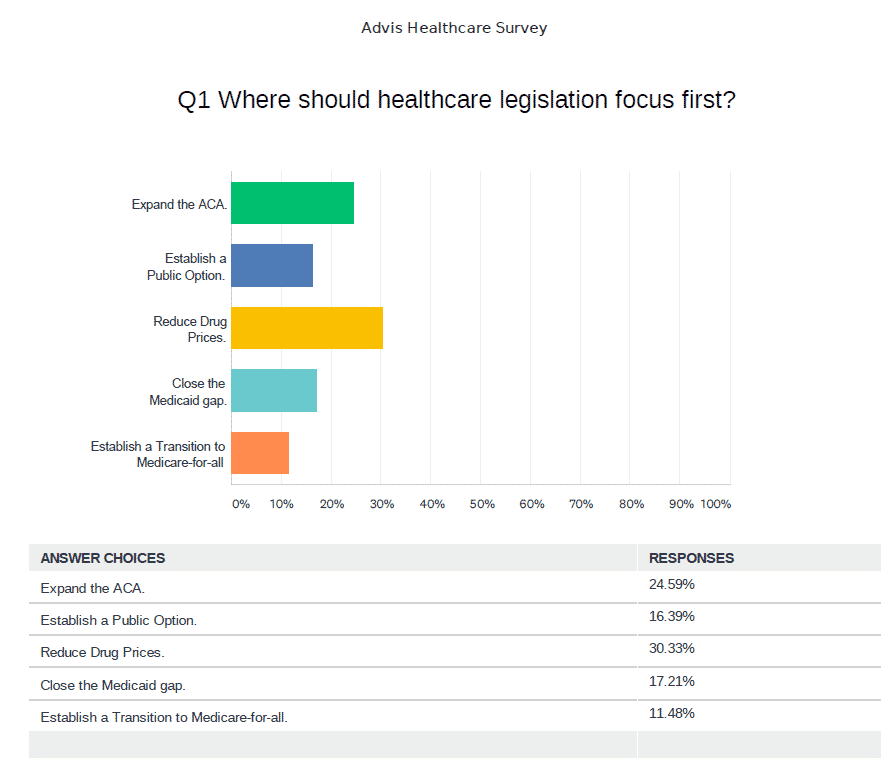

Respondents indicate that legislative initiatives should focus on reducing drug prices (over 30%) and expanding the ACA (almost 25%). Closing the Medicaid gap (17.21%) and establishing a Public Option (16.39%) came in a distant second to reducing drug prices and expanding the ACA. There was only 11.48% support for establishing a transition to Medicare-for-All.

Comments from individual executives ranged from “Support independent physician groups,” to “Reinstate catastrophic-only plans” that allow individuals to pay for their own routine care, to “Lower Premium costs for all insurance,” to “None of the Above” and “Do nothing.” Clearly, doing nothing is not an option. But a nuts-and-bolts approach to reform seems much more likely than an industry-wide embrace of sweeping reforms.

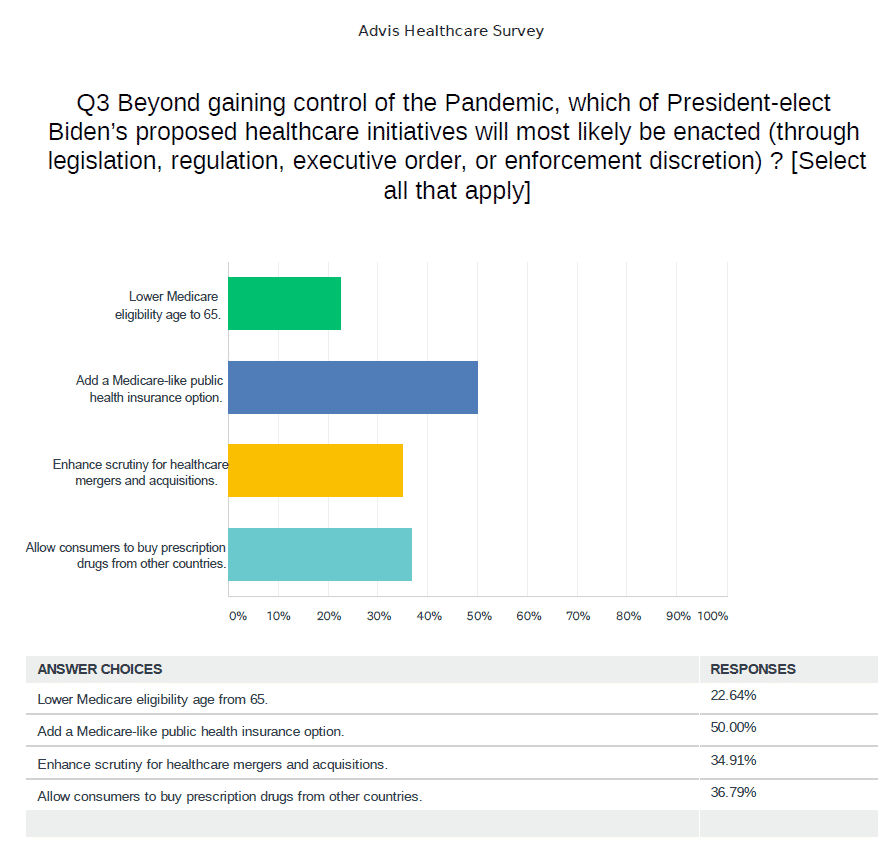

When pressed for greater specifics, 50.00% of respondents thought a “Medicare-like public health insurance option” a likely advance for the industry. Almost 37% thought allowing consumers to buy drugs from other countries, something that can already be done to a limited extent, another likely step forward. Almost 35% expect enhanced governmental scrutiny regarding mergers and acquisitions. Almost 23% expect the eligibility age for Medicare to be lowered from 65. It may well be possible to garner bi=partisan support for each of these reforms.

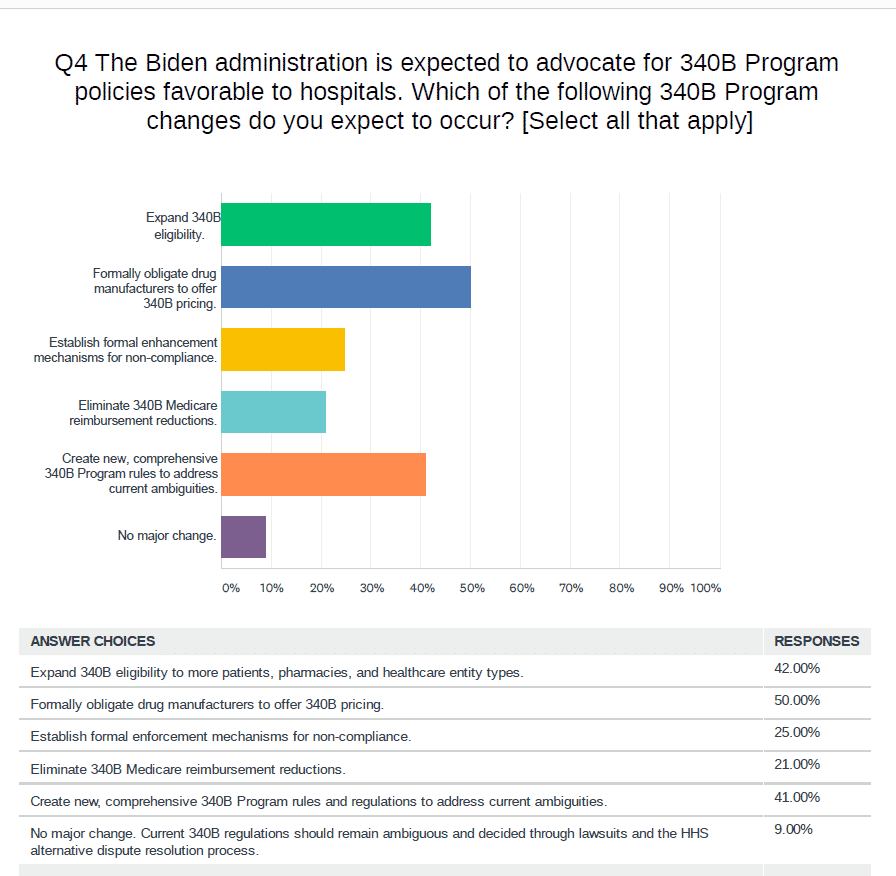

As for reforms to the 340B Program and ‘Surprise Billing’, only obligating drug manufacturers to offer 340B pricing garnered 50% support. As needs to be better understood by the public, 340B programs help pay the bills for hospitals big and small, urban and rural. Especially rural. 42% of respondents expect 340B eligibility to expand to more patients, pharmacies, and types of healthcare entities. 41% expect current program ambiguities to be addressed by new, more comprehensive program. 25% want formal enforcement mechanisms established for non-compliance with the rules and regulations. 21% would like to make sure any proposed reductions to Medicare reimbursements are eliminated.

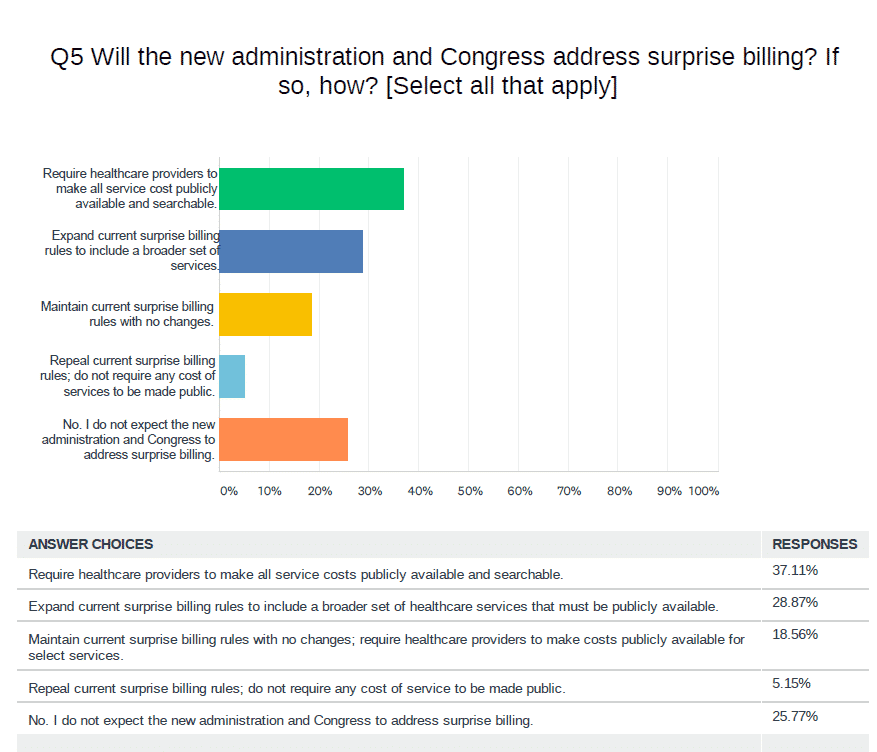

As for addressing Surprise Billing, the responses as to ‘How’ are less definitive. A little over 37% believe in the transparency rules requiring all service costs to be publicly available and searchable. Almost 29% would expand the current surprise billing rules to include an even broader set of healthcare services. Almost 26% don’t expect Congress or the new administration to address the issue at all. 18.56% would like to see no change from the current rules. Only 5% call for the surprise billing rule to be repealed, removing the requirement that cost-of-service be made public.

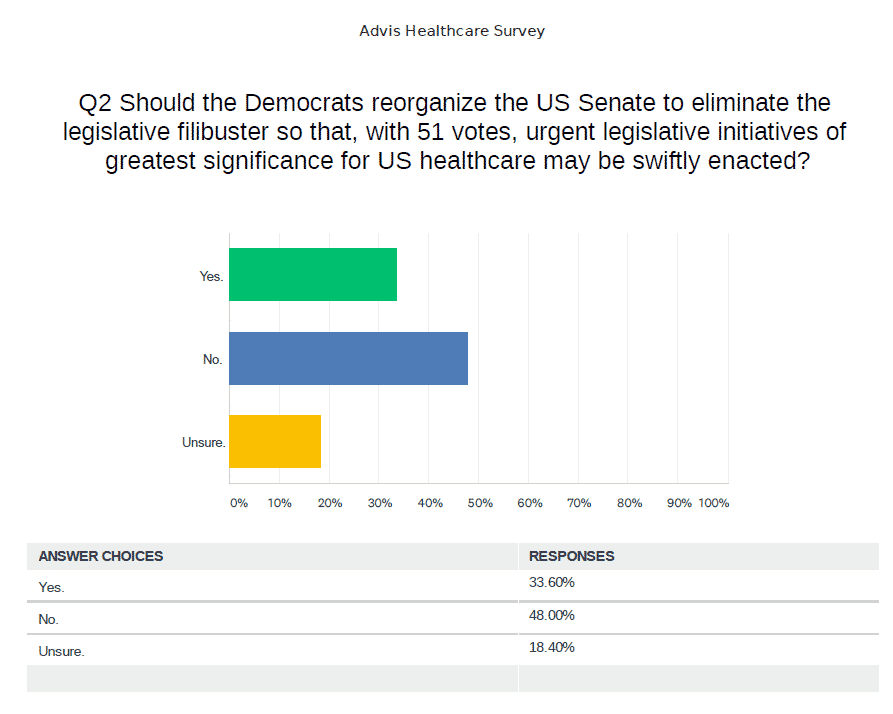

That leaves only the elephant in the room: Should the filibuster be abandoned by the Senate to get big things done? A solid 48% of respondents said that the filibuster should be maintained as is. 33.6% think it should be done away with. And 18.4% are unsure as to whether the filibuster should stay or go. These numbers may well reflect of greater representation of Republicans in healthcare industry C-suites. They may also reflect the ideological biases of the respondents. But if the reformers join hands with the undecideds, then the filibuster dies 52% to 48. It will be fascinating to see just how this defining issue plays out in the coming weeks and months.

One thing is certain, if the Biden Administration faces the same amount of obstruction endured by the Obama Administration, successful filibusters could spell doom for the reform and revitalization of the healthcare industry. Bi-partisan reform efforts might prove a great blessing. But something-somewhere-somehow will have to give if the industry on the front lines of the pandemic is to Build Back Better.

Published: January 26, 2021