https://advis.com/wp-content/uploads/2020/10/112147314_m.jpg

Throughout the course of the pandemic various federal and state funding sources have been made available to providers. Advis has assisted numerous clients in navigating the complex and ever-evolving web of guidance to maximize recovery and maintain compliance while avoiding any risk of “double-dipping”. In our experience, most healthcare providers have obtained some combination of (1) the Medicare Accelerated and Advanced Payment Program (“AAP”), (2) Provider Relief Funds (“PRF”), and (3) FEMA Disaster Relief funding. Many providers have also obtained ancillary grants from state and local sources or other federal agencies. Below is a high-level summary of the three funding sources noted above. A few best practice tips for moving forward with COVID-19 relief efforts are included below as well:

MEDICARE ACCELERATED AND ADVANCED PAYMENT PROGRAM

Early in the pandemic, CMS announced AAP loans for providers. Hospitals were eligible for up to six months advanced funding, and physician groups up to three months funding. In total, CMS estimates it issued $106.5B of AAP loans. Providers are now in the process of repaying these loans. Providers pay in either lump sums or via the recoupment process. The recoupment process takes a portion of Medicare claims and applies them to remaining balances as providers bill for services rendered.

Many high-profile providers have made public their repayment of these loans in full. For example, HCA repaid ~$4.4B in October 2020 and Mayo Clinic repaid $915M in July 2020. Amongst Advis clients, we continue to see a mix of entities that have chosen to repay these loans in full as well as those that allow the recoupment process to play out against their Medicare claims.

Advis does not see a “wrong way” to handle repayment between these two approaches. In general, we recommend that entities evaluate their financial positioning and make the best determination possible as to whether retaining the liquidity offered by these loans on a longer-term basis is beneficial to the organization. The effort required to monitor and comply with the recoupment process selected must be a factor in these deliberations.

PROVIDER RELIEF FUNDS

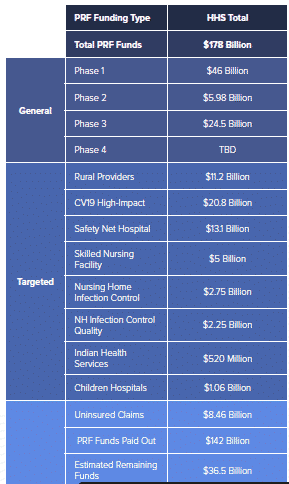

Congress established the Provider Relief Fund (“PRF”) in March 2020 to quickly provide grant funding to healthcare providers battling COVID-19 on the frontlines. Congress has appropriated $178B to the PRF< and has made distributions to providers either via direct allocations or application processes. Below is a chart of funding provided to date:

As shown in the chart above, funding is segregated into Targeted and General distributions. The type of distribution impacts how providers must report fund utilization to the government. For example, parent entities may report in a consolidated manner the receipt and utilization of general distributions among commonly owned subsidiaries; recipients of targeted distributions must report separately. At the same time, however, Congress has directed HHS to allow providers the ability to reallocate targeted funding from a subsidiary to a parent, such that the parent may direct the use of said funding amongst eligible subsidiaries. Although this statutory requirement exists, as of late July, HHS has not yet built functionality into the reporting portal for providers to effectively report these internal reallocations.

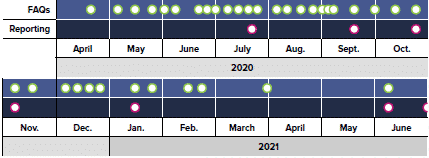

With respect to reporting and general compliance, HHS guidance has been ever-evolving. There have been significant changes in policy that have swung providers’ ability to retain PRF grants by millions of dollars. Providers must analyze the terms and conditions for each distribution type, various iterations of HHS reporting notices, constantly evolving guidance published as frequently asked questions, and myriad user guides, webinars, and other sources of information. Below is a chart showing just how frequently the FAQs alone have changed:

Despite HHS’ attempts to close the gaps via these frequent updates, significant open questions remain, as with the process to report reallocated targeted distributions noted above. Advis anticipates that HHS will continue to release guidance updates to address providers’ questions and on-going concerns.

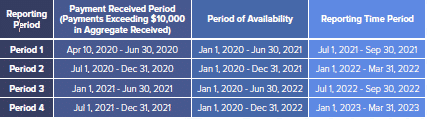

For now, providers should be preparing to submit their first official report to HHS by the hard deadline of September 30, 2021. The chart below describes the reporting periods and deadlines, which HHS has now segregated into four distinct parts based on when PRF was received:

Providers will report eligible General & Administrative and Healthcare-related expenses, as well as lost revenues, on a calendar year quarterly basis, to offset grant funding in each Period. As stated by HHS: “The Provider Relief Fund permits reimbursement of marginal increased expenses related to coronavirus provided those expenses have not been reimbursed from other sources or that other sources are not obligated to reimburse.” Providers may also choose to apply PRF payments toward lost revenues using one of three options:

- Option A: of the difference between actual patient care revenues;

- Option B: of the difference between budgeted (prior to March 27, 2020) and actual patient care revenues; and

- Option C: calculated by any reasonable method of estimating revenues.

(Options A and B utilize CY2019 as the comparative baseline.)

HHS will allow providers to carry-forward any “unused” expenses and lost revenues into future reporting periods.

Advis recommends that providers utilize the tools provided by HHS to begin organizing the substantial data involved in making this report. Specifically, preparing work papers that mimic the reporting elements for each entity that received a PRF distribution is essential, as well as is gathering the supporting documentation/data. Although HHS will not be requiring supporting documentation to be uploaded for most components of these reports, the agency has made clear that the burden of proving eligibility on audit will be on the providers. Proper documentation has future value. Document retention requirements have been set at three years.

FEMA FUNDING

FEMA reimburses eligible entities, including non-profit healthcare providers, for expenses incurred in performing Emergency Protective Measures. Similar to PRF, FEMA guidance has evolved significantly throughout the course of the pandemic. In general, though, FEMA will provide 100% reimbursement for expenses utilized in “Emergency Protective Measures”, including but not limited to:

- Materials and Supplies (e.g., Personal Protective Equipment (“PPE”), testing supplies, cleaning and disinfection, screening and temperature scanning, etc.);

- Rented and/or Purchased Equipment;

- Construction and/or Renovations of Temporary and/or Expanded Medical Facilities;

- Forced Account Overtime and Contract Labor;

- Vaccine-related Expenses; and

- Medical Care to COVID-19 Positive or Presumed Positive Patients.

In analyzing public data provided by FEMA, it appears that only ~400 hospitals have obtained disaster relief funding so far during the pandemic (or ~7% of American hospitals), resulting in ~$2.1B in obligated funding. For entities that have not yet availed themselves of this opportunity, Advis recommends evaluating immediately whether submitting an application is an option. To do so, providers should determine whether any eligible expenses remain unreimbursed after offsetting all PRF and other grant funding received to date.

Preparing FEMA filings is no small task. The agency is notoriously scrutinous, and requires substantial data (in the form of contracts, invoices, proofs of payment, narrative descriptions, etc.) to support each expense on a line-by-line basis. FEMA audits, which may occur up to six years after grant close out, have also been historically difficult to navigate, and may result in return of a portion of the initial award absent extreme care.

Although some questions exist surrounding the timing of FEMA filings as compared to reporting PRF utilization to the government, FEMA eligibility for providers will continue until September 30, 2021, pursuant to an Executive Order issued by President Biden earlier this year. According to Advis’ FEMA contacts, providers will thereafter have 60 days to file any remaining completed project reports in most regions, and six months thereafter to close out grants.